Is cataract surgery covered by private health insurance?

Cataract surgery is one of the most common and successfully performed operations worldwide, offering a solution to those experiencing blurred, clouded, or dim vision due to cataracts. The question of whether cataract surgery is covered by private health insurance is pivotal for many individuals considering their options for this life-changing procedure. Additionally, understanding how this fits alongside NHS provision is crucial for anyone navigating their treatment choices in the UK.

This blog post delves into the coverage of cataract surgery by private health insurance and how it compares with NHS services, helping you understand what to expect and how to prepare.

Understanding cataracts and the need for surgery

Cataracts develop when the clear lens of the eye becomes clouded, affecting vision. Surgery, which involves the replacement of the cloudy lens with an artificial one, is the only definitive way to restore vision affected by cataracts. Given the procedure’s necessity and prevalence, understanding the nuances of insurance coverage, alongside the options available through the NHS, is essential.

Cataract surgery covered by private health insurance

The coverage for cataract surgery under private health insurance policies can vary significantly. Here are the key factors that influence whether your procedure might be covered:

Type of health insurance plan

- Comprehensive Plans: Most comprehensive private health insurance plans are likely to cover cataract surgery as part of their inpatient procedure benefits. These plans are designed to provide broad medical coverage, including a range of surgical procedures.

- Specific or Limited Plans: Some insurance plans offer limited coverage or are designed to cover specific areas of health. For these, it’s crucial to check if cataract surgery is included.

Waiting periods

Private health insurance policies often include waiting periods for certain conditions or procedures. For cataract surgery, this period can vary. Understanding the specific waiting periods within your policy is crucial to timing your surgery.

Policy exclusions

Always review your policy’s exclusions. Some policies might exclude cataract surgery explicitly or have conditions under which the surgery would not be covered.

Pre-existing conditions

If cataracts were a pre-existing condition at the time you took out your insurance policy, there might be different rules regarding coverage. Some insurers may cover the surgery after an additional waiting period, while others may not cover it at all.

The NHS route

In contrast to private coverage, the NHS provides cataract surgery free of charge to eligible patients, typically those experiencing significant vision impairment that affects their daily lives. The NHS route offers the advantage of cost savings, with patients receiving high-quality care without the direct financial burden. However, waiting times can be longer than those experienced with private healthcare, and there may be less flexibility in choosing your surgeon or the type of intraocular lens (IOL) implanted.

Questions to ask your insurance provider

To clarify the extent of your coverage for cataract surgery, consider asking your insurance provider the following questions:

- Is cataract surgery covered under my current policy?

- What is the waiting period before I can claim for cataract surgery?

- Are there any exclusions or conditions that could affect my coverage?

- Does my policy cover the cost of the pre-surgery consultation and post-surgery follow-up?

- What lenses are covered under the policy? Are premium intraocular lenses (IOLs) included?

Additional costs to consider

Even with private health insurance, there may be additional costs or out-of-pocket expenses, such as deductibles, co-payments, and costs for premium IOLs not covered by insurance.

Navigating insurance for cataract surgery

Understanding your health insurance coverage or opting for NHS treatment involves weighing the benefits of each route. Discussing your options with both your ophthalmologist and insurance provider, or the NHS, can ensure you have a clear understanding of covered services and any potential costs.

For more in-depth information on navigating private health insurance for cataract surgery, including tips on understanding your policy and preparing for the costs, download our comprehensive guide today.

Considering cataract surgery and wondering about your insurance coverage? Book a free assessment with our specialists to discuss your options and get personalised advice tailored to your insurance situation. Our team can help you understand the coverage provided by your private health insurance and assist in planning your cataract surgery journey with confidence.

Take the first step

Our life-changing treatments aren’t suitable for everyone.

The first step is to get our guide so you can find out how to avoid the biggest mistake people make when having cataract surgery

Our most popular procedures

What our patients say…

“I would like to thank you all for looking after me so well”

“Thank you and your team very much indeed for looking after me during my initial visit and the day of cataract surgery.”

“Excellent service from the reception staff to theatre staff & Dr G…fabulous great aftercare… thank you! I would highly recommend.”

We have replaced the images of real patients who provided these testimonials to protect their privacy.

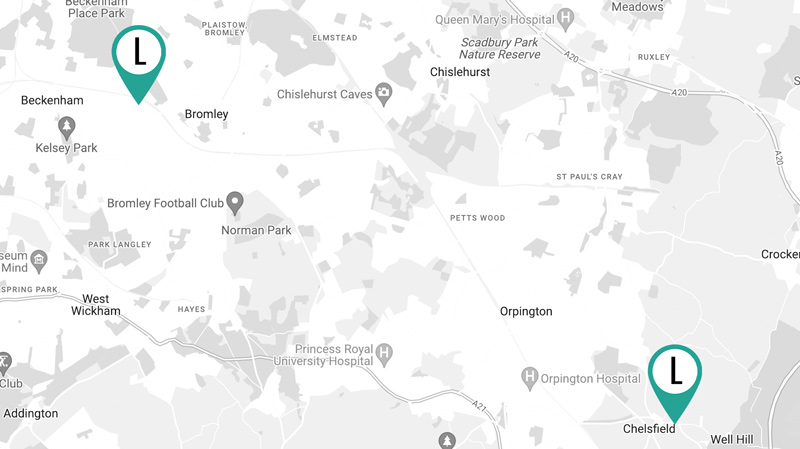

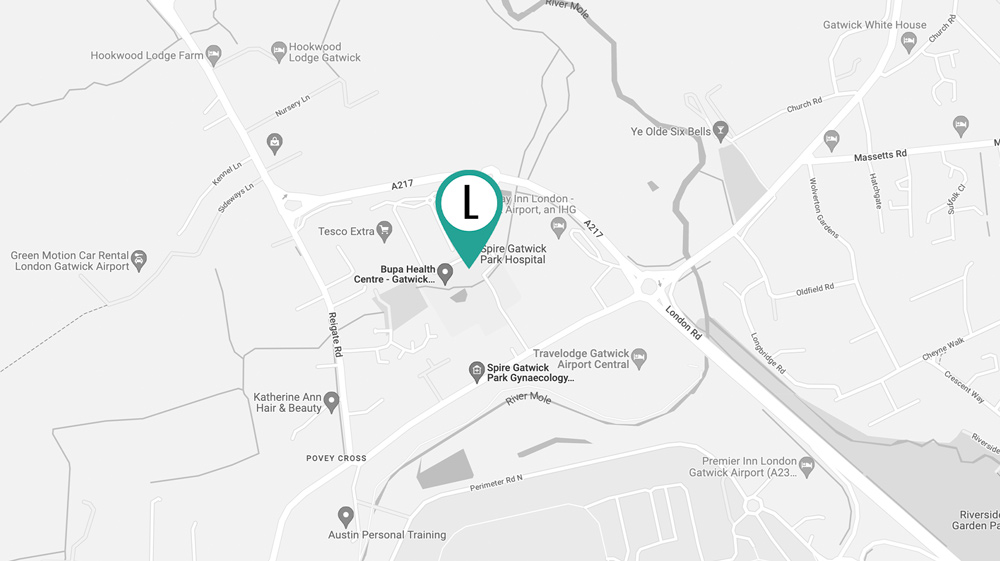

Hello, I’m Lucia Pelosini MD, your eye surgeon in Surrey & Kent

My vision is to provide my patients with warm and personalised guidance through their cataract surgery journey from start to finish. I run a highly individualized service to treat discerning patients with presbyopia (aging eyes) and cataracts who want the best treatment and technology available.

Ms. Lucia Pelosini

Consultant Ophthalmic Surgeon,

MD, MRCSEd, FRCOphth, CertLRS